In this blog, we’ll examine the key international expansion strategies, and how companies can determine which one is right for their business. We’ll also highlight the importance of adapting your international expansion strategy to suit your target market. Companies should be mindful that just because something has worked well in one country, it doesn’t necessarily mean it can be successfully replicated in another.

International market-entry strategies

Firstly, let’s visit the key international market-entry strategies which have been deployed by global companies.

1. Exporting

A strategy strongly favoured by the majority of SMEs and start-ups, exporting is regarded as low risk and allows rapid entry into a new market. Exporting goods enables companies to dip their toes in the water in a foreign market with minimal investment and risk. Read our top tips for new exporters here.

2. Licensing and franchising

By signing licensing or franchising agreements, it will enable foreign companies to sell or represent your brand in those markets. There are lots of issues to consider such as achieving product or service consistency, messaging, positioning, as well as Intellectual Property. Companies must ensure that legally binding contracts are drawn-up.

3. Partnering and strategic alliances

This popular method allows you to leverage local expertise and contacts. Partnerships are usually formed on a win-win scenario. This requires a stronger commitment compared to exporting or licensing. It’s advisable to choose a partner who is a good ‘corporate fit’ with your own business, and one who shares similar values and ambitions.

4. Wholly-owned subsidiary through acquisition

This is a fast market-entry route compared to organic growth. The management team and infrastructure in the acquired company are usually retained. International acquisitions can get complicated when it comes to integration, and this strategy is often reserved for larger, cash-rich companies.

5. Wholly-owned subsidiary through greenfield venture

This entry mode means the firm owns 100% of the overseas entity, and your company will enter the new international market by establishing a completely new operation and legal entity. Although you retain full control, this strategy entails higher levels of risk and expense, as well as longer start-up times.

Factors influencing international market-entry strategies

How do you decide which international market-entry strategy is best for your business? This critical decision is influenced by a number of internal and external factors, which we’ll explore in greater detail.

Internal factors

Internal factors are company-specific factors, such as your assets, company size and your own international experience, that will be affecting your international market-entry strategy. If you own a large company with high cash reserves, wider entry-mode options will be accessible to you. Smaller companies may be limited to utilising entry modes with lower commitment, such as exporting. If you provide a service, then either licensing or acquisition is often favoured as a preferred market-entry mode. For example, PWC, one of the big four global accountancy firms, has often chosen acquisition as a means of continuing their expansion.

External factors

The PESTLE (political, economic, social, technological, legal, environmental) analysis is commonly used as a tool to monitor a company’s external environment when they are planning to launch into a new market and choosing international market-entry strategy.

Political

Companies need to look at the extent to which the government intervenes in the economy. Is it politically stable? What are the trade tariffs? What are the levels of red tape and bureaucracy? How quickly could you set-up a business in that country? The time it takes to set up a business varies by country, and if you want a quick ROI, each day matters.

Economic

These are factors such as economic growth rate, GDP growth, unemployment rate, exchange rate fluctuations. You’ll need to consider these, and also whether there are incentives designed to attract foreign direct investment, which might shape the outcome of your decision.

Social

What is the state of the local talent pool? Is there an ageing population? How educated is the workforce? What languages do they speak? Are there cultural differences between them and your current domestic workforce?

Technological

What are the Intellectual Property legislations in that market? Are there any government R&D incentives? The digitisation of government red tape and taxation is another important consideration. In the 2020, World Bank ‘Doing Business’ report, ranked those countries with digital systems for filing corporate income tax and value added tax returns as more attractive. For example, in Poland, since 2020 VAT returns have been submitted using a standard audit file for tax (SAF-T), thereby simplifying the whole process. [2]

Legal

What are the local employment laws, payroll, taxation, and health and safety requirements? Does the Government intervene? e.g., is there a minimum wage stipulation or is it a free market economy? What are the compliance legislations? e.g., GDPR in Europe.

Environmental

The global issue of climate change will continue to be a key driver for change in purchasing behaviour. What are the policies relating to energy consumption or waste disposal in that market? For example, in the UK residential market, the Government announced that fossil fuel heating will no longer be installed in new homes after 2025. What carbon footprint targets might be imposed on your business? e.g., UK Government’s 2030 deadline for zero global warming potential (GWP).

Market factors

Porter’s 5 forces model is a useful tool to assess market factors which will shape your international market-entry strategy. The model analyses:

- competitive rivalry

- threat of substitute products

- bargaining power of buyers

- threat of new entrants

- bargaining power of suppliers

For further reading, check out our blog: How to identify your target market, which highlights how you can apply the 5 forces model to assess the attractiveness of your target market. Market factors also stipulate your international market-entry strategy. Research has shown that in markets where uncertainty is higher, companies favour entry modes which give them higher levels of control. [1]

“Life is neither static nor unchanging…in an inherently changing world, any species unable to adapt is also doomed.”

Jean M Auel

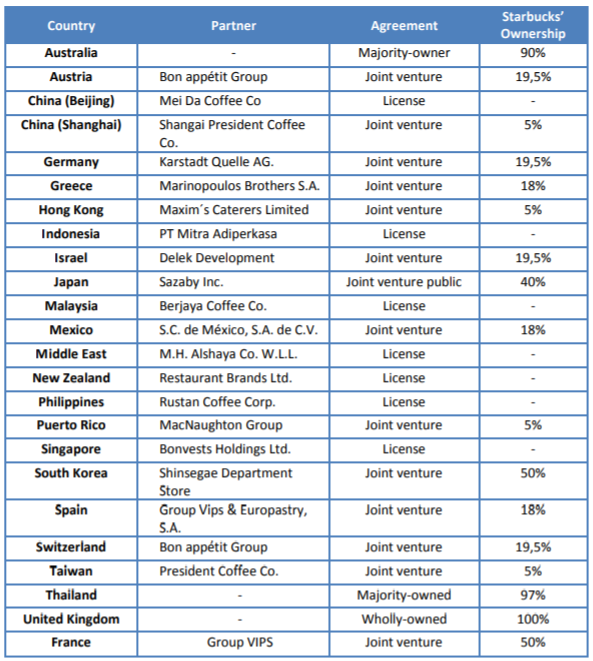

Global companies may use different strategies for each new market they enter. A classic example is the global coffee chain, Starbucks. They adapt their international market-entry strategy for every market. This table depicts the market-entry strategy used in the different countries they have targeted:

The Starbucks story began in Seattle in 1971, it wasn’t until 1985, that they started to expand to different US cities, eventually targeting Canada. From the table above, we can conclude that they deploy three different entry strategies, joint venture, licensing and wholly-owned subsidiaries. [1]

- Joint Venture – In 2001, Starbucks used a joint venture to enter Spain, forming a partnership with the VIPS Group, a famous Spanish restaurant chain. Their first store opened the following year.

- Licensing – In 1998, Starbucks penetrated New Zealand by opening their first store in Auckland. They granted a license to the local company, Restaurant Brands New Zealand Ltd.

- Wholly-owned subsidiary – acquisition was an efficient way for Starbucks to enter the UK market. Starbucks purchased 65 Seattle Coffee Company stores in 1998. The UK was the first European country which Starbucks entered, providing a springboard for them to expand into Europe.

Macro factors affecting locations

In the last decade or so, we have witnessed a shift to regional manufacturing with the Government advocating this through seeking to establish regional trade agreements. Tighter regulations on emissions in China have forced companies to look elsewhere for their manufacturing. It’s no longer about labour costs alone, with other factors, such as the location of end-consumers coming into play. We have seen a growing number of manufacturing suppliers from emerging markets such as North Africa, Central and Eastern Europe, India, and ASEAN. These markets have an increasingly affluent middle class with higher disposable income, and businesses are choosing to locate geographically closer to these groups, enabling them to respond quicker to their demands. [3]

So how do you choose your international market-entry strategy?

As demonstrated by Starbucks, there is no one-size-fits-all approach. Your market-entry strategy needs to be adapted to fit your target market, and the market you’re entering. Companies must consider their internal and external factors. We have provided guidance to many SMEs and start-ups, with help ranging from exporting and licensing to the formation of partnerships and wholly-owned subsidiaries. Over 75 businesses successfully entered new markets with our help. Our experts will look at your business, consider your goals and objectives and advise an international market-entry strategy accordingly. Get in touch, today.

References:

1. Entry Modes of Starbucks

2. How five countries have modernised their tax systems

3. Growth strategies for an uncertain world

Further insights on international market-entry strategy & global success:

If you enjoyed our article on how to choose your international market-entry strategy, join our Discovery Lite portal for free below. You’ll get access to a monthly insights magazine and bonus downloadable materials to help your business reach new markets: